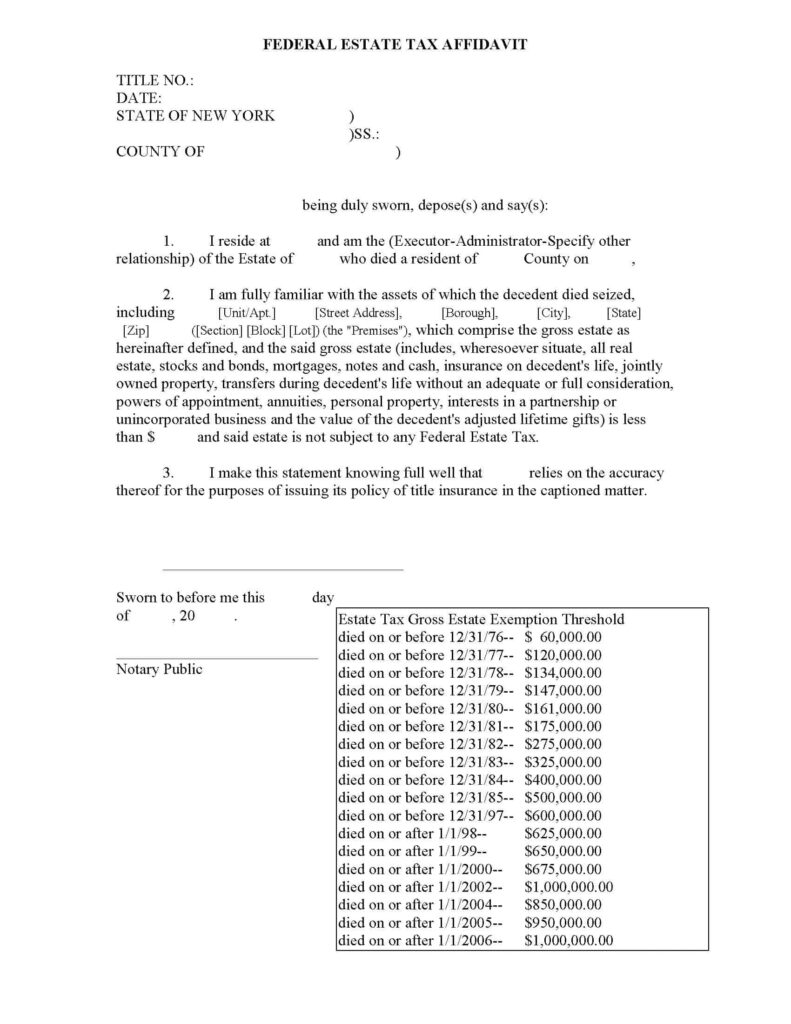

Federal Estate Tax Affidavit Form – If you have an estate, you will want to use a properly formatted Estate Affidavit Form. This file is not really submitted in the the courtroom and ought to be provided on the person or business that is acquiring your estate. Typically, this person would be a bank. You should give the form to the bank if you own a home. Below are great tips for implementing the Real estate Affidavit Type in your state. Federal Estate Tax Affidavit Form.

The Big Apple Small Property Affidavit

The New York Small Residence Affidat can be a legal document that needs to be completed and signed by the individual who would like to inherit a deceased person’s home. It needs to checklist all personal house properties of the decedent as well as the full price of it. Private property contains autos and basic assets. True house consists of houses and land. Some suggests do not allow exchanges of genuine house, so this sort of file is needed in such a scenario.

Whether or not you need this document depends on the state’s laws, but in general, a small estate consists of assets worth $5,000 to $175,000, excluding real estate. The Brand New York Little Estate Affidavit Type is often utilized jointly with a will to easily simplify the probate procedure. The shape comes in Phrase and Pdf file formats, and it will be published out and finished all on your own.

Indiana Tiny Property Affidavit

A little residence affidavit kind is utilized by curious parties to gather possessions in the decedent. This particular type must be completed by 45 time right after dying and should are the decedent’s complete lawful name and interpersonal safety amount. Furthermore, the decedent’s full in depth address during loss of life has to be provided. The affidavit should be approved prior to a notary community. Frequently, this particular type can be utilized even without a individual agent.

The web based edition of your Indiana little residence affidavit type 49284 might be completed online. The record might be saved and edited within the PDF file format. By using a Pdf file editor, it is simple to comprehensive and indicator the record. Furthermore, the form could be completed in many methods. You can use a template for the document, but you may need to add your own information.

Connecticut Tiny Real estate Affidavit

If an individual dies leaving a small estate in Connecticut, a smaller probate process can be used to avoid court costs and time. These types are intended for estates below forty 1000 $ $ $ $ and are generally employed as soon as the deceased possessed no real-estate. An executor could data file a Connecticut Tiny Estate Affidavit Form and swear to inform all the other claimants. To be accredited, the form needs to be sworn prior to a notary community.

The shape could be finished on-line. Filling up it out is often as straightforward as keying in inside the correct type field. You can even click the blue pack to set your cursor inside the proper placement. Then, it is possible to kind the text you would want to use in the form. Once you’ve completed the form, you’ll must signal it. Ensure that you set up output deadlines and keep a schedule useful so that you don’t overlook to provide signatures.

Wyoming Tiny Property Affidavit

The initial step in developing a Wyoming Tiny Property Affida Vit is preparing a type. To get going, acquire a free version in the type through the formal landing page. After you’ve acquired the form prepared, it can be time to start checking output deadlines. Here are some ideas for filling out the shape. You can always use an online tool if you’re not sure how to format the document correctly.

You must include a information of your residence you’re seeking to liquidate. Intangible residence should be based on the financial institution, whilst real products needs to be shown. The affiant’s unique can be a necessary part of confirming the information inside the petition. It will consist of their deal with. As well as the affiant’s personal, the affiant have to confirm everything contained in the petition.