Florida Affidavit Of No Florida Estate Tax Due Form – You will want to use a properly formatted Estate Affidavit Form if you have an estate. This record is just not submitted in a court and must be provided to the man or woman or business that is getting your estate. This person would be a bank, typically. You should give the form to the bank if you own a home. Follow this advice for implementing the Residence Affidavit Kind where you live. Florida Affidavit Of No Florida Estate Tax Due Form.

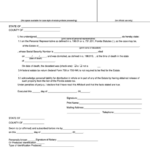

New York Modest Estate Affidavit

The New York Modest Real estate Affidat is a authorized document which needs to be signed and completed by the one who would like to inherit a deceased person’s property. It must listing all personal house owned by the decedent and also the complete value of it. Private property involves autos and common valuables. Actual residence contains houses and land. Some claims do not let moves of actual home, so this particular document is necessary in such a condition.

In general, a small estate consists of assets worth $5,000 to $175,000, excluding real estate, though whether or not you need this document depends on the state’s laws. The Newest York Little Property Affidavit Develop is normally used in conjunction with a will to simplify the probate procedure. The shape can be purchased in Term and Pdf file formats, and it will be printed out out and completed all by yourself.

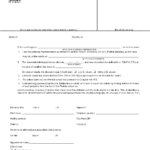

Indiana Modest Property Affidavit

A compact estate affidavit develop can be used by curious functions to gather possessions through the decedent. This form must be completed by 45 times soon after dying and must are the decedent’s whole legitimate name and sociable stability quantity. Additionally, the decedent’s whole in depth tackle at the time of passing away needs to be integrated. The affidavit needs to be approved before a notary public. Typically, this form can be used even without having a personalized agent.

The online variation of your Indiana modest estate affidavit type 49284 may be filled out online. The document could be edited and saved within the Pdf file format. Using a Pdf file editor, it is simple to complete and signal the record. Furthermore, the shape could be filled out in several ways. You may need to add your own information, though you can use a template for the document.

Connecticut Small Real estate Affidavit

A smaller probate process can be used to avoid court costs and time if an individual dies leaving a small estate in Connecticut. These kinds are suitable for estates beneath 40 1000 money and are generally used as soon as the deceased had no real estate. An executor may document a Connecticut Small Property Affidavit Develop and swear to notify all the other claimants. Being accepted, the form needs to be sworn well before a notary public.

The form can be completed on the internet. Filling it out is often as simple as typing inside the suitable kind industry. You may also click the blue container to set your cursor in the suitable position. Then, you can variety the words you would want to include in the shape. Once you’ve done the form, you’ll have to signal it. Ensure that you establish deadlines and keep a schedule useful so you don’t forget to add signatures.

Wyoming Small Estate Affidavit

Step one in developing a Wyoming Little Residence Affida Vit is planning a form. To begin, download a totally free copy in the develop through the official website landing page. When you’ve acquired the shape all set, it can be a chance to start off monitoring output deadlines. Below are great tips for filling out the form. You can always use an online tool if you’re not sure how to format the document correctly.

You should incorporate a information of your residence you’re wanting to liquidate. Intangible house should be based on the bank, although tangible items ought to be outlined. The affiant’s trademark is actually a essential part of proving the info from the application. It ought to incorporate their tackle. Along with the affiant’s personal, the affiant need to authenticate everything contained in the application.